Investors Are Bullish on Senior Housing

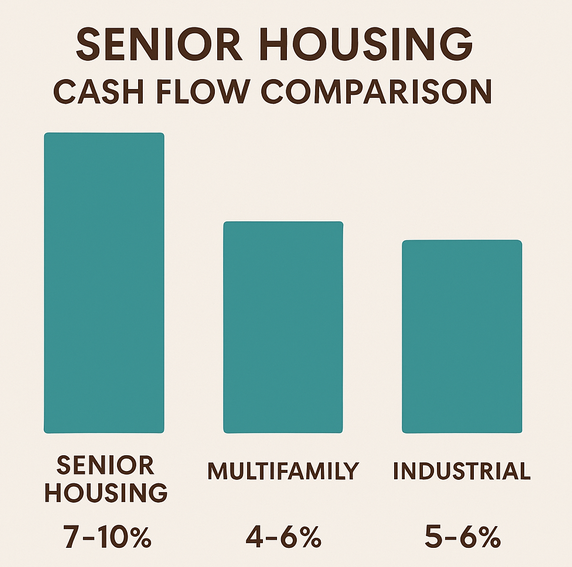

ULI and PREA just placed senior housing at the top of commercial real estate. ULI’s survey shows 32% of investors expect the best risk-adjusted returns from senior housing over the next three years, while the PREA Consensus Forecast ranks the sector #1 overall with projected 10.3% total returns.

“The need is huge, supply is tight, and great operators are making a real difference.”

Confidence Backed by Data

The findings from the ULI Economic Forecast Webinar (Oct 16, 2024) and the PREA Consensus Forecast (2025) confirm what we see on the ground: senior housing combines durable demand with improving operating performance, placing it alongside data centers as a leading allocation target for institutions.

Why Institutional Confidence Is Rising

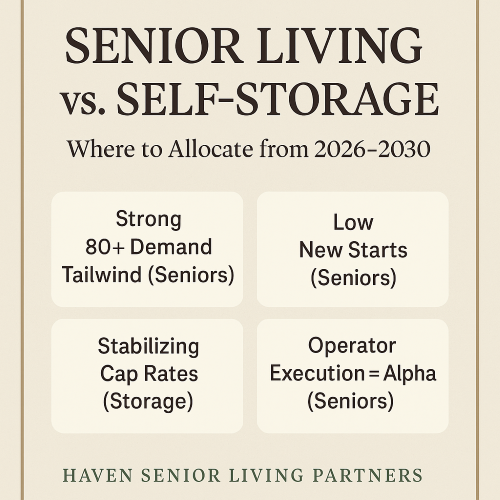

1) Demographic Tailwinds

With more than 10,000 Americans turning 65 every day, the senior population will grow for decades. This structural demand underpins occupancy, rate growth, and long-term stability for well-located communities.

2) Constrained New Supply

Higher construction costs, financing hurdles, and labor constraints have slowed development. In many markets, supply growth trails demand—creating favorable fundamentals for existing assets and targeted expansions.

3) Operations that Create Value & Impact

Senior housing is a people-first operating business. The best operators integrate hospitality, clinical coordination, and technology to elevate outcomes—delivering mission-aligned returns for investors and measurable benefits for residents and families.

Performance Meets Purpose

Few categories offer the same alignment of financial performance and social value. Each successful community eases family burden, supports caregivers, and creates local jobs—while providing secure, dignified living for America’s seniors.

For investors seeking stable income, diversification, and meaningful impact, senior housing stands out as a long-run winner.

Sources: ULI Economic Forecast Webinar (10/16/2024); PREA Consensus Forecast, 2025 Total Returns.