As the clock ticks toward what many economists, including real estate cycle expert Phil Anderson, predict will be a historic market top in 2026, investors across the country are growing increasingly uneasy. The classic 18–20-year real estate cycle—14 years of expansion followed by 4 years of sharp correction—has played out with eerie precision for more than two centuries. If Anderson’s model holds, we are just a short distance from another correction.

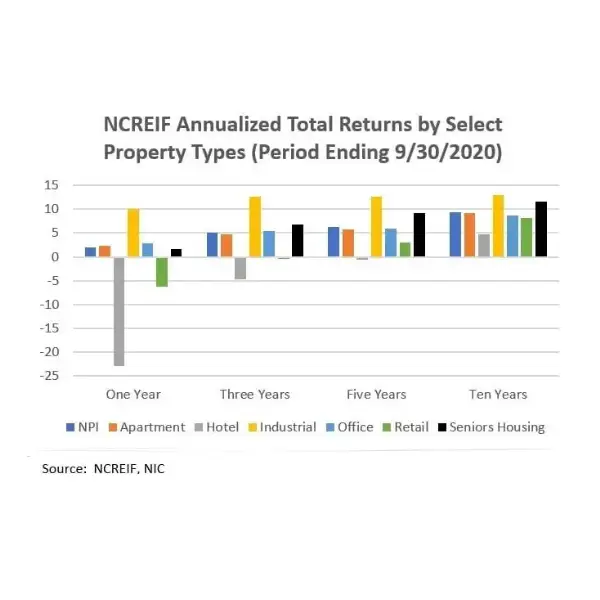

But while office towers, luxury condos, and speculative land deals may face turbulence, senior housing stands apart. In fact, as the broader market inches toward what could be a generational reset, senior housing may prove to be one of the most resilient—and even opportunistic—sectors in commercial real estate.

Here’s why:

1. Demographics Don’t Crash

Unlike speculative booms, the demand for senior housing is driven not by hype, but by demographics—the most predictable force in real estate. Every day, 10,000 Baby Boomers turn 65. By 2030, over 73 million Americans will be seniors. By 2035, for the first time in U.S. history, older adults will outnumber children.

That wave is still building—and it’s unstoppable.

While land values and credit markets rise and fall, aging is recession-proof.

2. Senior Housing Is Needs-Based, Not Wants-Based

In downturns, consumer discretionary spending drops, speculative projects collapse, and luxury asset values deflate.

But assisted living, memory care, and skilled nursing serve a different role: they are part of the care continuum, often non-negotiable for families. Unlike short-term rentals or luxury multifamily, senior housing isn’t about lifestyle—it’s about necessity.

When the next crash hits, the question won’t be “Do I want this?” It’ll be, “Where can Mom get the care she needs?”

3. Durable Cash Flow in a Fragile Market

High leverage and cap rate compression are already taking down multifamily deals that were thin to begin with. But stabilized senior housing communities—especially those under professional management—can deliver durable, operationally-driven income. With average lengths of stay ranging from 18 to 36 months, and rising monthly rents (often bundled with services), the cash flow profile is sticky and defensive.

Many family offices are already shifting toward senior housing for this reason: income resilience.

4. Irreplaceable Infrastructure at a Discount

As the broader market corrects, expect distressed opportunities in underperforming senior housing assets. For patient capital, this means acquiring irreplaceable facilities at below-replacement cost, at a time when new development will stall due to tighter credit.

If you believe the crash is coming, then the most strategic move isn’t to retreat from real estate—it’s to shift into sectors with downside protection and secular tailwinds.

5. Long-Term Public Policy Support

Medicare, Medicaid waivers, tax credits, HUD financing, and Veteran benefits continue to underwrite much of the senior housing and healthcare infrastructure. As the political pressure to address eldercare grows, so does the likelihood of continued government support, even in recession.

Investors who position themselves within this framework can weather volatility—and potentially thrive.

Final Thought: The Opportunity Beneath the Cycle

Phil Anderson’s message is clear: Don’t try to beat the cycle. Prepare for it.

In a market that’s overheated and overleveraged, many asset classes will suffer. But senior housing isn’t a speculation—it’s a societal need. And when the dust settles, it will be the investors who anchored their portfolios in essential, cash-generating real estate who emerge strongest.

When the tide goes out, senior housing won’t be naked—it’ll be standing firm, serving a growing population in need, and rewarding those with the vision to invest in substance over speculation.

Interested in how senior housing fits into your post-2026 strategy?

Let’s talk about aligning your capital with care-driven, demographic-backed real estate.