Executive Summary

A looming disruption in the U.S. bond market is raising red flags across all financial sectors. As Jamie Dimon, CEO of JPMorgan Chase, warns of an inevitable “crack” in the bond market due to unsustainable fiscal policies, commercial real estate (CRE) investors must understand the ripple effects that such stress can cause. This white paper explores the mechanics of a bond market crack and how it directly impacts financing, valuations, and risk across CRE assets—especially in interest-rate-sensitive sectors like senior housing.

What Is a Bond Market Crack?

A “crack” refers to dysfunction in the bond market, where yields rise sharply, liquidity dries up, and pricing becomes volatile. This can occur due to:

Surging U.S. debt levels

Rising inflation expectations

Waning demand for U.S. Treasuries

Policy missteps or delayed Federal Reserve responses

In Dimon’s words: “You’re going to see a crack in the bond market. It is going to happen… and you are going to panic.”

How This Impacts Commercial Real Estate

1. Spiking Interest Rates and Cap Rates

Bond yields serve as the benchmark for CRE loan rates and cap rates.

A sharp rise in Treasury yields will lead to higher borrowing costs and upward pressure on cap rates.

Result: Lower property valuations, especially for deals reliant on low-cost leverage.

2. Frozen Debt Markets

A bond market disruption can stall lending from banks and CMBS markets.

CRE projects—particularly new developments or refinancings—may be delayed, repriced, or fail entirely.

3. Liquidity Risk and Forced Sales

Investors facing margin calls or maturing debt may be forced to sell CRE assets at a discount.

Assets with short-term floating-rate debt (common in CRE bridge loans) are especially vulnerable.

4. Investor Flight to Safety

Capital shifts away from CRE and into more stable, liquid assets like short-term Treasuries.

This may reduce transaction volumes and widen the bid-ask spread.

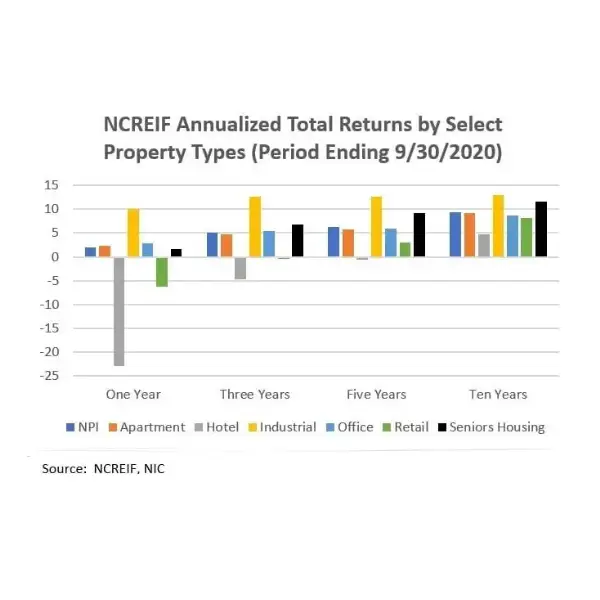

Sector Spotlight: Senior Housing

Senior housing stands out in this environment due to:

Recession resistance: Driven by demographic demand, not discretionary trends.

Inflation-hedged revenue: Leases often have annual rent escalators tied to CPI.

Government-backed financing: HUD 232 loans offer stability during lending freezes.

While interest rate spikes challenge valuations, senior housing retains a countercyclical advantage over traditional office or retail CRE.

Strategic Recommendations

For CRE Investors:

Stress test portfolios against higher cap rates and tighter credit.

Lock in fixed-rate debt where possible.

Focus on essential-use, cash-flowing properties (e.g., senior housing, medical offices).

Establish lender relationships with HUD/FHA and mission-driven banks.

For LPs and Family Offices:

Re-evaluate exposure to floating-rate real estate funds.

Prioritize sponsors with a track record of navigating high-rate cycles.

Look for value-add opportunities in sectors benefiting from demographic tailwinds.

Conclusion

A crack in the bond market is not just a macroeconomic concern—it is a direct threat to commercial real estate valuations, financing, and liquidity. However, with proactive strategies and a focus on resilient sectors like senior housing, investors can navigate and even thrive during the storm.

For more information or off-market senior housing opportunities, visit SLInvestors.com.