Investment Outlook • 2026–2030

Senior Living vs. Industrial: Where to Allocate from 2026–2030

Need-based housing & care versus logistics-driven warehouses—fundamentals, risks, and strategy.

Research Brief

By Haven Senior Living Partners

Updated:

1) Five-Year Setup: 2025 Baselines → 2030

Senior Living Scarce new supply; occupancy & rate growth depend on operator quality.

Industrial E-commerce, 3PL, nearshoring support demand; local big-box pockets still absorbing 2022–24 deliveries.

2) Demand & Supply Drivers (2026–2030)

| Dimension | Senior Living | Industrial |

|---|---|---|

| Structural demand | 80+ cohort acceleration; need-based. | Logistics seculars (last-mile, reshoring, inventory re-balancing). |

| Supply governor | Capital, labor, licensure. | Land, zoning, construction costs; transportation adjacency. |

| Ops intensity | High (care & staff). | Low; credit/rollover management. |

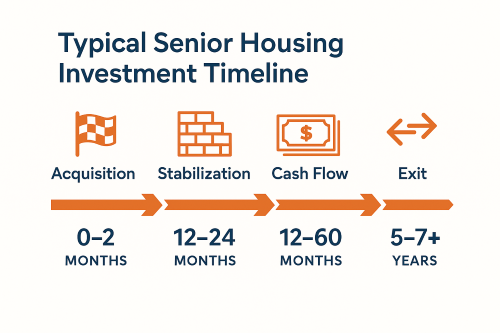

| Lease tenor | Short (resident agreements). | Longer (3–7+ years typical). |

3) Pricing, Returns & Risk Posture

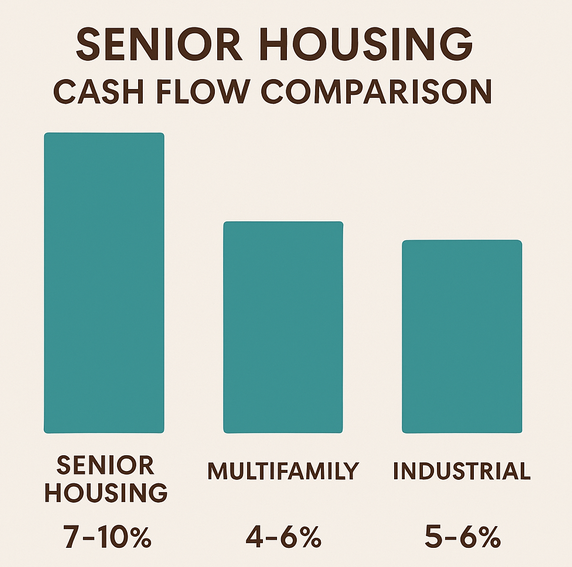

- Entry yields: Seniors often higher initial yields; Industrial mid-range with wide variance by infill vs. big-box.

- NOI trajectory: Seniors: upside from lease-up/rate strategy; Industrial: steadier ramps via escalators and low opex.

- Sensitivities: Seniors: wages/regulatory. Industrial: tenant credit, transportation costs, speculative supply.

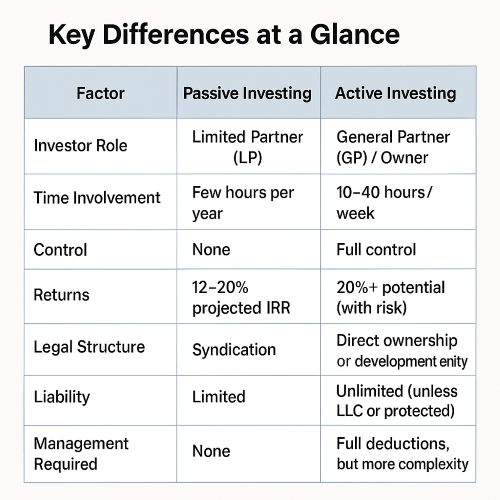

4) Who Should Favor Which?

Choose Senior Living for operational alpha in undersupplied markets.

Choose Industrial for simpler operations and longer leases—especially infill last-mile with constrained land.

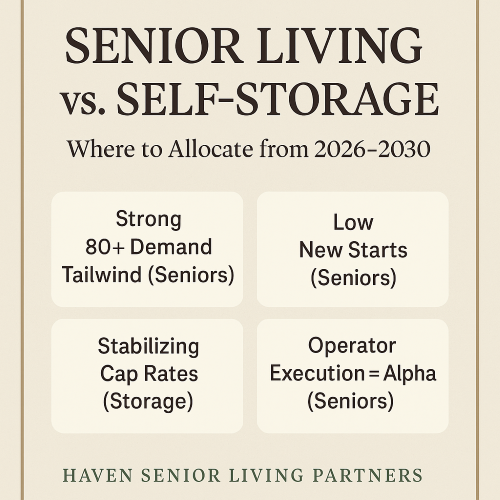

5) Quick Scorecard (2026–2030)

| Criterion | Senior Living | Industrial |

|---|---|---|

| Structural demand tailwind | Strong | Strong |

| New supply pressure | Low | Easing (market-specific) |

| Execution risk | Operator & labor | Tenant credit/rollovers |

| Alpha opportunities | Lease-up, reposition, acuity mix | Infill scarcity, small-bay demising |

Bottom Line

Operator advantage → Seniors: best upside if you can manage wages and acuity.

Lower-touch durability → Industrial: longer leases, low capex; prioritize infill/port-adjacent nodes.

Sources & Notes

- Sector baselines from 2025 investor surveys and public filings.

Methodology: 2025 baselines projected through 2030.

Talk with a Senior Housing Strategist

Haven Senior Living Partners