Senior Living vs. Data Centers: Where to Allocate from 2026–2030

Need-based housing & care versus hyperscale compute infrastructure—side-by-side fundamentals, risks, and strategy.

1) Five-Year Setup: 2025 Baselines → 2030

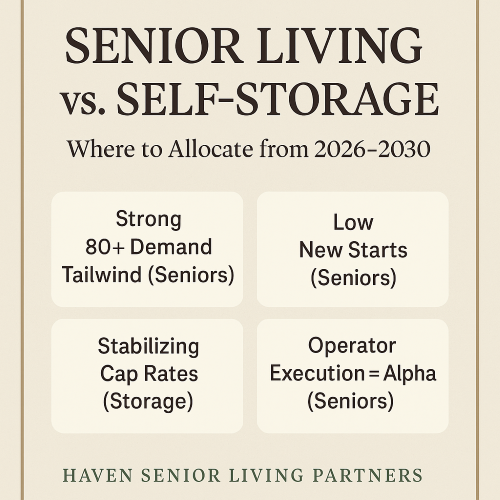

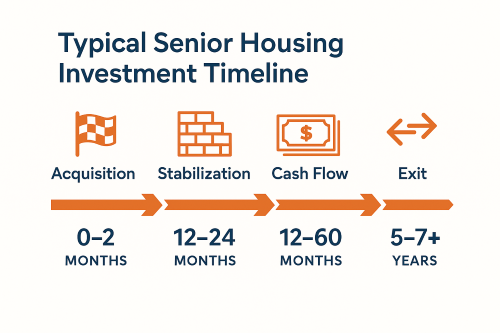

Senior Living Demographic surge (80+), constrained new starts, operator-execution alpha.

Data Centers AI/cloud demand, scarce power & interconnect, long leases; development and utility constraints are key governors.

2) Demand & Supply Drivers (2026–2030)

| Dimension | Senior Living | Data Centers |

|---|---|---|

| Structural demand | Need-based move-ins; 80+ cohort accelerates. | AI training/inference, cloud, edge; rising rack density (kW/rack). |

| Supply governor | Capital & labor; licensure/regulation. | Power availability, substation lead times, fiber proximity, zoning. |

| Ops intensity | High (care, staffing, compliance). | Low-to-moderate (mission-critical uptime; technical ops). |

| Lease tenor | Short (month-to-month resident agreements). | Longer (5–15+ yrs; take-or-pay/esc’s common). |

3) Pricing, Returns & Risk Posture

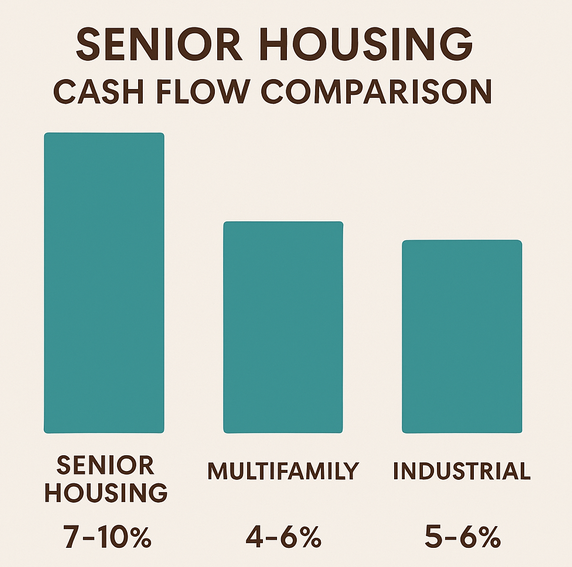

- Entry yields: Seniors typically higher starting cap rates; Data centers often lower yields but strong rent escalators tied to power/fit-out.

- NOI trajectory: Seniors: rate + occupancy gains if wage management holds. Data centers: contracted escalators, power pass-throughs; development spreads where power secured.

- Sensitivities: Seniors: labor/regulatory. Data centers: power lead times, chip cycles, tenant concentration.

4) Who Should Favor Which?

Choose Senior Living for demographic tailwinds and operational alpha via top-quartile operators.

Choose Data Centers if you can lock power/interconnect and underwrite long-term credits; heavier development expertise required.

5) Quick Scorecard (2026–2030)

| Criterion | Senior Living | Data Centers |

|---|---|---|

| Structural demand tailwind | Strong | Very strong (AI/cloud) |

| New supply pressure | Low (starts constrained) | Power-limited (permits/grid) |

| Execution risk | Operator & labor | Power/land/tenant concentration |

| Alpha opportunities | Lease-up, reposition, acuity-mix | Development spreads where power secured |

Bottom Line

Operator advantage → Seniors: better risk-adjusted upside with constrained supply and aging demand.

Infrastructure edge → Data Centers: lower-touch income with escalators if you control power and delivery.

Sources & Notes

- Sector baselines from 2025 investor surveys, public REIT reporting, and industry briefings.

Methodology: forward view anchored to 2025 baselines, scenario-tested through 2030.

Talk with a Senior Housing Strategist

Haven Senior Living Partners