Senior Living vs. Self-Storage: Where to Allocate from 2026–2030

A side-by-side, investor-grade comparison using today’s 2025 baselines to project risk, return, and strategy through 2030.

1) Five-Year Setup: 2025 Baselines → 2030

Seniors Housing Occupancy rising on decade-low new supply; investors expecting cap-rate compression into 2026.

Self-Storage Fundamentals stabilized after 2024; pipeline ~2.7–2.8% of stock with rents normalizing off promo levels.

2) Demand & Supply Drivers (2026–2030)

| Dimension | Senior Living | Self-Storage |

|---|---|---|

| Structural demand | 80+ cohort surges through 2030; need-based move-ins. | Mobility, life events, SMB & e-commerce usage; durable but cyclical. |

| Near-term supply | Starts at multi-year lows → tailwind for occupancy & rates. | Pipeline eased to ~2.7–2.8% → less new competition vs. 2021–23. |

| Ops intensity | Higher (labor, licensure). Manager quality is critical. | Lower-touch ops with revenue-management sensitivity. |

3) Pricing, Returns & Risk Posture

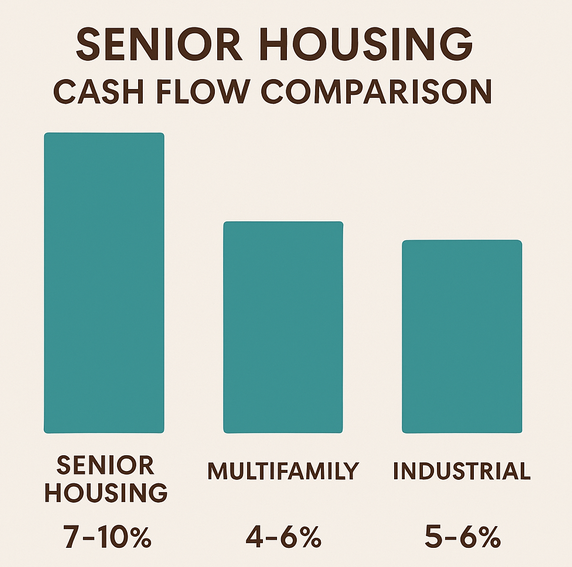

- Entry yields: Seniors showing compression bias into 2026; Storage stabilized higher than 2021 lows (~mid-5s to low-6s).

- NOI trajectory: Seniors positioned for above-trend growth if wage management holds; Storage modest growth as promos burn off.

- Cycle sensitivities: Seniors: labor & regulation; Storage: housing turnover and local supply pockets.

4) Who Should Favor Which?

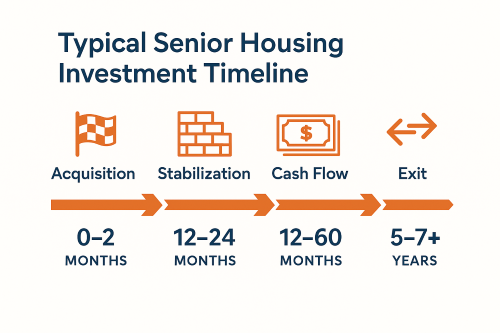

Choose Senior Living if you want demographic tailwinds + scarce supply and you can underwrite/partner with top operators (or employ HUD-232 where appropriate).

Choose Self-Storage if you want simpler ops and steady cash flow, accepting mid-single-digit growth unless you buy exceptional basis or submarkets.

5) Quick Scorecard (2026–2030)

| Criterion | Senior Living | Self-Storage |

|---|---|---|

| Structural demand tailwind | Strong (80+ surge) | Moderate (mobility/e-com) |

| New supply pressure | Low (starts at lows) | Easing (pipeline ~2.7–2.8%) |

| 2025–26 pricing trend | Compression-bias | Stabilized vs. 2021 |

| Execution risk | High (operator-led) | Lower ops intensity |

| Recession resilience | Need-based; labor/reg risks | Historically resilient; housing-churn sensitive |

| Alpha opportunities | Lease-up, reposition, care-mix | Revenue mgmt, micro-market selection |

6) Strategy Ideas for 2026–2030

| Theme | Application |

|---|---|

| Submarket Discipline | Prioritize undersupplied seniors submarkets and storage MSAs with pipeline ≤ ~2.5% of stock. |

| Capital Stack | Consider HUD-232 on stabilized AL/MC; in storage, lock fixed-rate or ladder maturities. |

| Value Creation | Seniors: acuity & rate strategy, staffing efficiency, brownfield/expansion. Storage: rate-card normalization, fee income, ops tech. |

| Underwriting | Model conservative wage inflation in seniors; conservative rent growth in storage; basis > pro forma. |

Bottom Line

If you have operator advantage: Seniors housing offers the better risk-adjusted upside 2026–2030 (structural demand + constrained supply + improving pricing).

If you prefer simpler, steadier ops: Self-storage remains attractive as a cash-flow asset—expect bond-like total returns unless you buy mispriced or supply-tight deals.

Sources & Notes

- NIC MAP data & commentary on seniors housing occupancy, supply, and absorption (2025).

- CBRE Investor & cap-rate surveys (mid-2025) across alternative sectors.

- ULI / PwC Emerging Trends in Real Estate® 2025 — operational niche outlooks.

- Public REIT filings and sector updates for self-storage supply pipeline and rent trends (2024–2025).

Methodology: forward view anchored to 2025 baselines, then scenario-tested through 2030.

Talk with a Senior Housing Strategist

Haven Senior Living Partners • Dallas HQ •