Haven Senior Living Partners

The Triple Advantage: Opportunity Zones + 100% Bonus Depreciation + Rural Market Growth

An investor white paper on leveraging reauthorized Opportunity Zones, restored 100% Bonus Depreciation, and the overlooked advantages of rural senior housing & healthcare real estate.

Executive Summary

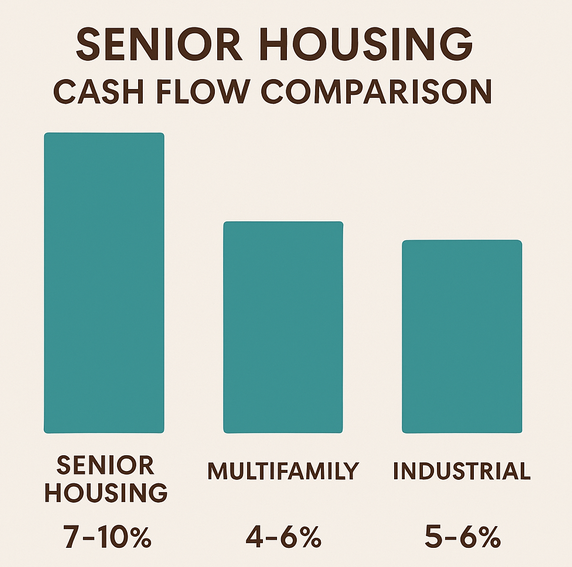

In 2025, Congress reaffirmed two powerful incentives shaping U.S. real estate capital formation: the Opportunity Zone program and 100% Bonus Depreciation. When paired with the structural advantages of rural senior housing & healthcare real estate, investors can align tax efficiency, durable cash flow, and high-impact community outcomes.

- Opportunity Zones reauthorized: Continued deferral and potential elimination of capital gains tax via Qualified Opportunity Funds (QOFs) with ≥10-year holds.

- 100% Bonus Depreciation restored: Immediate, full expensing for qualifying components identified through cost segregation.

- Rural market edge: Higher senior concentrations, limited supply, lower basis, and overlapping federal/state finance tools (USDA, HUD-232) drive compelling risk-adjusted returns.

Opportunity Zones (OZ): Policy Certainty & Community Impact

Opportunity Zones (created by the 2017 Tax Cuts and Jobs Act) were extended in 2025, sustaining incentives for gains deferral, basis step-ups, and long-term tax-free appreciation on OZ investments held ten years or more. With 8,700+ designated tracts—many in rural and micropolitan areas—OZs remain a durable policy tool for channeling private capital to underserved communities.

Investor Benefits

- Deferral of prior capital gains by reinvesting into a QOF within 180 days.

- Reduction of taxable deferred gain via basis adjustments (per current law).

- Exclusion of OZ investment gains after ≥10-year hold.

Why Senior Housing?

- Essential-need category with demographic tailwinds (aging population).

- Clear, measurable community outcomes (beds, jobs, access to care).

- Long-duration holds that align with the OZ 10-year incentive horizon.

See eligible tracts on our Opportunity Zone map and our Investor Portal.

100% Bonus Depreciation: Front-Loaded Tax Shield

The 2025 legislation restored full expensing (100%) for qualified property placed in service. With a professional cost segregation study, personal property and land improvements can be rapidly depreciated, creating substantial first-year deductions that improve after-tax IRR.

| Purchase Price | $8.6 million |

| Cost-Seg Eligible Assets | $2.0 million |

| Immediate Deduction (100%) | $2.0 million |

| Estimated Tax Savings (@ 37%) | ≈ $740,000 |

For illustration only. Not tax or legal advice. Consult your CPA and counsel.

The Rural Advantage: Senior Density, Supply Gaps, Lower Basis

Rural counties host some of the highest concentrations of 65+ residents in the U.S., yet many communities have no assisted living or memory care within 25 miles. Land and construction costs are commonly 30–50% lower than metro peers. Many rural tracts overlap with Opportunity Zones and qualify for USDA, HUD-232, and state-level credits—stackable with 100% bonus depreciation to enhance equity efficiency.

- Demand: High 65+ ratios and aging-in-place trends create stable occupancy potential.

- Supply: Limited or aging inventory; barriers to entry create defensible positions.

- Financing: USDA community facilities, HUD-232 mortgage insurance for seniors housing, state programs.

Top 20 Rural & Micropolitan OZ Markets with Robust Healthcare Systems

Shortlist aligned with OZ coverage, tertiary/trauma-capable hospitals, regional referral radius, and favorable basis.

| # | Market | Regional Health System | Trauma / Bed Count | OZ Presence |

|---|---|---|---|---|

| 1 | Grand Junction, CO | Intermountain / St. Mary’s | ≈310 beds (Level II) | Yes |

| 2 | Springfield, MO | CoxHealth / Mercy | Level I–II | Yes |

| 3 | Johnson City, TN | Ballad Health JCMC | Level I | Yes |

| 4 | Roanoke, VA | Carilion Clinic | Level I | Yes |

| 5 | Morgantown, WV | WVU Ruby Memorial | Level I | Yes |

| 6 | Rapid City, SD | Monument Health | Level II | Yes |

| 7 | Billings, MT | Billings Clinic | Level I | Yes |

| 8 | Missoula, MT | Providence St. Patrick | Level II | Yes |

| 9 | Idaho Falls, ID | EIRMC | Level II | Yes |

| 10 | Twin Falls, ID | St. Luke’s Magic Valley | Level IV (STEMI I) | Yes |

| 11 | St. George, UT | Intermountain Regional | Level II | Yes |

| 12 | Yuma, AZ | Yuma Regional | Level II | Yes |

| 13 | Farmington, NM | San Juan Regional | Level III | Yes |

| 14 | Grand Island, NE | CHI Health St. Francis | Regional | Yes |

| 15 | Kearney, NE | CHI Good Samaritan | 268 beds | Yes |

| 16 | Tyler, TX | UT Health Tyler | Level I | Yes |

| 17 | Temple, TX | Baylor Scott & White | Level I | Yes |

| 18 | Abilene, TX | Hendrick Health | Level III | Yes |

| 19 | Hattiesburg, MS | Forrest General | Level II | Yes |

| 20 | Dothan, AL | Southeast Health | Level II | Yes |

Request the detailed tear-sheets with tract IDs, hospital stats, and underwriting notes: Get Market Tear Sheets.

Haven Senior Living Partners: Triple-Advantage Model

- Locate: Identify OZ-qualified rural parcels near robust health systems and senior density.

- Structure: Form/Utilize a Qualified Opportunity Fund, run cost segregation to capture 100% bonus depreciation, and align debt with HUD-232/USDA options.

- Stabilize: Acquire/develop, optimize operations, and hold ≥ 10 years to capture OZ tax-free appreciation.

- Report & Impact: Track occupancy, care access, jobs, and ESG-aligned outcomes.

Review our pipeline on the Investor Portal or subscribe to Deal Alerts.

Quick Diligence Workflow

1) OZ Fit

Confirm tract eligibility and zoning; verify utilities and ingress/egress. Save parcel IDs and tract codes.

2) Health System Depth

Check trauma level, service-line breadth, and referral radius; confirm physician density and payor mix.

3) Incentive Stack

Evaluate USDA/HUD-232/state credits; run cost seg; model 100% bonus depreciation; test sensitivities.

4) Operate & Measure

Stabilize occupancy/margins; report tax, financial, and community outcomes to LPs and lenders.

Key Risks & Mitigants

- Policy risk: Law/IRS guidance changes — Mitigant: prioritize projects that pencil even without incentives; engage experienced tax counsel.

- Construction & cost inflation: Mitigant: GMP contracts, contingency reserves, phased scope.

- Operator risk: Mitigant: partner with proven senior-living operators; align fees with NOI and quality metrics.

- Demand variability: Mitigant: thorough market study, hospital alignment, Medicare/Medicaid strategy.

- Liquidity: OZ 10-year horizon — Mitigant: diversified pipeline, refinance options, interim distributions if permitted.

Nothing herein is investment, tax, or legal advice. Accredited investors should consult professional advisors.

Frequently Asked Questions

How do Opportunity Zones reduce my capital gains taxes?

Investors reinvesting eligible gains into a Qualified Opportunity Fund within 180 days can defer recognition until the statutory deadline or disposition. With a ≥10-year hold, post-investment gains can be excluded under current law.

Is 100% bonus depreciation really back?

Yes—2025 legislation restored full expensing (100%) for qualified property placed in service. Cost segregation identifies components to maximize the first-year deduction.

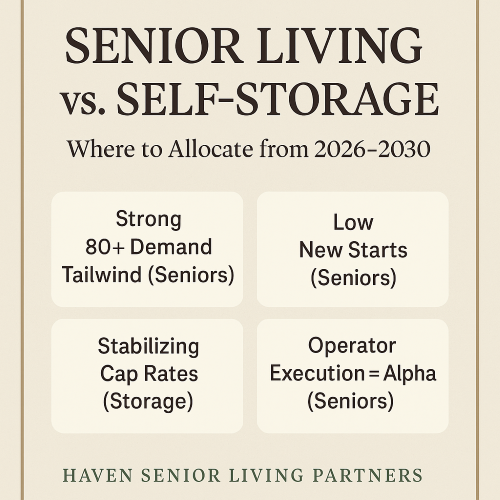

Why senior housing in rural markets?

High senior density, limited supply, and lower basis improve underwriting. Many rural tracts overlap with OZ designations and pair well with HUD-232/USDA programs.

What’s the typical hold period?

We target ≥10 years to align with OZ tax-free appreciation; we underwrite mid-term refi options subject to performance and market conditions.

Are distributions allowed during an OZ hold?

Potentially—subject to cash flow, project covenants, and tax counsel guidance. OZ rules allow certain debt-financed distributions; facts and timing matter.

Does bonus depreciation create passive losses I can use?

Treatment depends on your status (e.g., real estate professional, material participation) and aggregation elections. Coordinate with your CPA.

What qualifies under HUD-232?

HUD-insured mortgages for healthcare facilities including assisted living and memory care. The program can improve leverage, amortization, and cost of capital.

Will Medicare/Medicaid mix affect performance?

Yes. We evaluate payor mix, local incomes, waiver programs, and operator strategy when underwriting each market.

Can I invest via IRA/qualified plan?

Often yes (self-directed), but consider UBTI/UBIT implications; consult your plan custodian and tax advisor.

How do I review current offerings?

Visit our Investor Portal, request a call, or subscribe to Deal Alerts for new rural OZ senior-living opportunities.

Glossary (for Investors & AI Search)

- Qualified Opportunity Fund (QOF)

- An investment vehicle organized to deploy capital into Opportunity Zone property under IRS regulations.

- Cost Segregation

- Engineering/tax study separating building components to accelerate depreciation and capture 100% bonus on eligible items.

- HUD-232

- Federal mortgage insurance for senior housing & healthcare projects.

- USDA Community Facilities

- Programs supporting essential community infrastructure in rural areas; can enhance project capital stack.

- Trauma Level (I–IV)

- Designation of hospital emergency/trauma capability; proxy for regional healthcare depth.

Invest with Haven Senior Living Partners

Access institutional-grade, mission-aligned opportunities at the intersection of Opportunity Zones, 100% bonus depreciation, and rural senior housing.

Haven Senior Living Partners • 5050 Quorum Dr, Suite 700, Dallas, TX 75254 slinvestors.com