In today’s rapidly evolving economic landscape, the senior housing sector presents a once-in-a-generation investment opportunity. At Haven Senior Living Partners, we are uniquely positioned to help investors capitalize on this potential with our proprietary pipeline of off-market investments.

Why Invest Now?

The Perfect Storm for Investment:

A confluence of factors has created a perfect storm for investing in senior housing. The rapid rise in interest rates, coupled with the maturity of floating debt, has led to overleveraged assets and a significant reset of property values. This reset has opened the door for investors to acquire senior housing real estate at a 20-30% discount to replacement value.

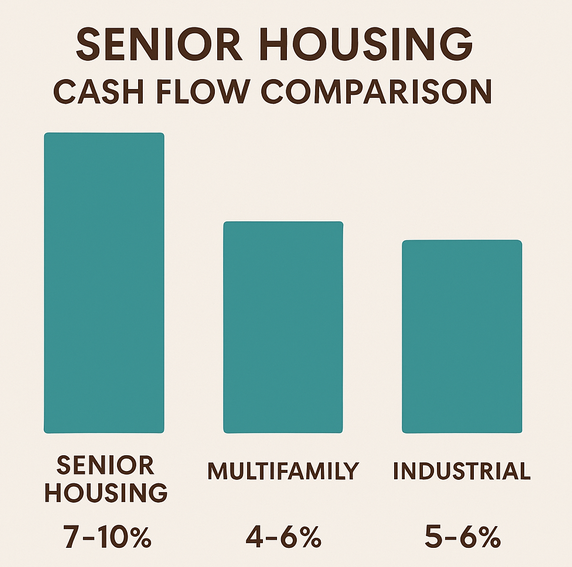

Outstanding Returns:

Investors can expect exceptional returns with Haven. Our investments are structured to deliver 20%+ IRR and 2x+ MOE. Senior housing is a recession-resistant, needs-based investment with a long runway for sustained returns.

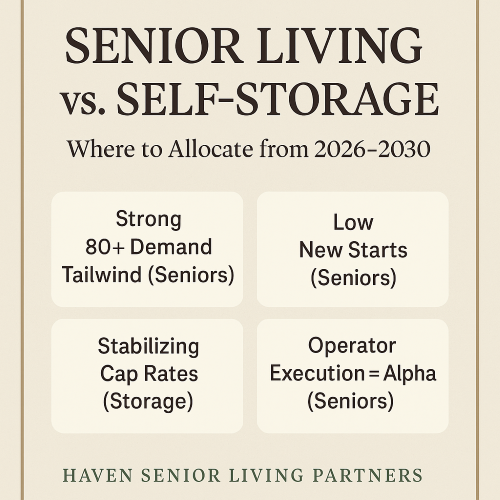

Demographic Tailwinds:

Strong demographic trends support the senior housing market. With an aging population, demand for senior housing is projected to outstrip supply, driving future growth and stability in this sector.

Operational Value-Add:

Our experienced management team excels at operational value-add strategies. By increasing rents, optimizing cost structures, and boosting NOIs, we enhance asset performance and investor returns.

Why Haven Senior Living Partners?

Proprietary Investment Pipeline:

Our proprietary pipeline offers investors exclusive access to off-market senior housing investments. These opportunities are carefully vetted to ensure they meet our stringent criteria for value and potential.

Market Stabilization:

We hold assets until markets stabilize, benefiting from lower cap rates and higher valuations. By refinancing at lower interest rates, we further enhance investment returns.

Acquiring at a Discount:

We acquire assets at a discount to replacement cost, locking in margins of safety to minimize downside risk. This strategy ensures rapid value creation and a strong foundation for long-term growth.

Recession-Resistant Investment:

Senior housing is a needs-based, recession-resistant investment. This sector’s stability, combined with our strategic approach, makes us an ideal partner for investors seeking solid returns in uncertain times.

Take the Next Step

The senior housing market is poised for significant growth, and we are at the forefront of this opportunity. If you are ready to invest in a sector with substantial upside potential and positive social impact, contact us today. Together, we can build thriving communities and achieve outstanding returns.

By leveraging our expertise and strategic approach, we are your gateway to high-performing senior housing investments. Don’t miss out on this unparalleled opportunity to secure your financial future while making a meaningful difference in the lives of seniors.