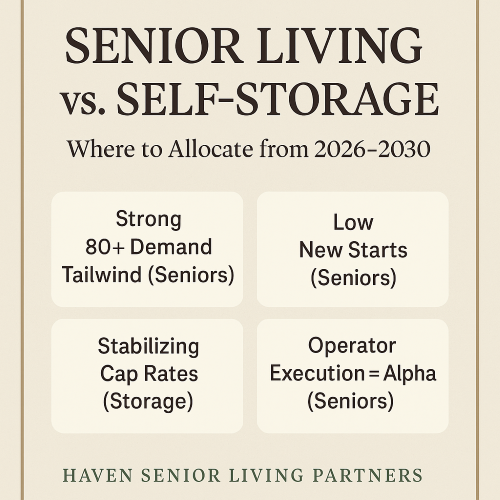

As we approach 2025, the economic landscape is anticipated to feature persistently high interest rates and elevated tariffs, creating challenges for investments across sectors. The senior housing sector, traditionally supported by favorable demographic trends, faces pressures from increased construction and operational costs. However, it remains one of the most promising areas for long-term investors due to the aging baby boomer population and an increasing demand for senior housing.

By 2030, the U.S. Census Bureau estimates that all baby boomers will be 65 or older, constituting over 20% of the U.S. population. This dramatic demographic shift will increase the demand for senior housing, projected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. Additionally, the National Investment Center for Seniors Housing & Care (NIC) projects that the senior housing market’s valuation will surpass $500 billion by 2035. This whitepaper provides strategies for navigating the senior housing sector in a high-tariff, high-interest-rate environment.

Economic Landscape: No Rate Cuts and Higher Tariffs

The Federal Reserve has signaled that interest rates will likely remain elevated through 2025, with the current federal funds rate standing at 4.40% as of late 2024. For real estate investors, higher borrowing costs reduce yields on debt-financed projects, while tariffs, which have increased construction material costs by 15%-20% since 2018, add further constraints. Rising costs for steel, lumber, and concrete have particularly impacted senior housing developments, where quality and durability are non-negotiable.

Key Statistics:

- Interest Rates: A 1% increase in interest rates can reduce real estate valuation by approximately 10% to 15%, depending on leverage.

- Tariffs: The U.S. Chamber of Commerce estimates that tariffs have added $3.4 billion annually to construction costs across the housing sector, disproportionately impacting large developments.

- Inflation Impact: Inflation in labor and energy costs has further increased operational expenses for senior housing facilities by an average of 8% annually since 2022.

In this challenging environment, established properties with stabilized cash flows have become more valuable as new developments face escalating costs. Investors must consider these dynamics when evaluating opportunities in the senior housing sector.

Key Strategies for Investing in Senior Housing

1. Focus on Stabilized, Cash-Flowing Properties

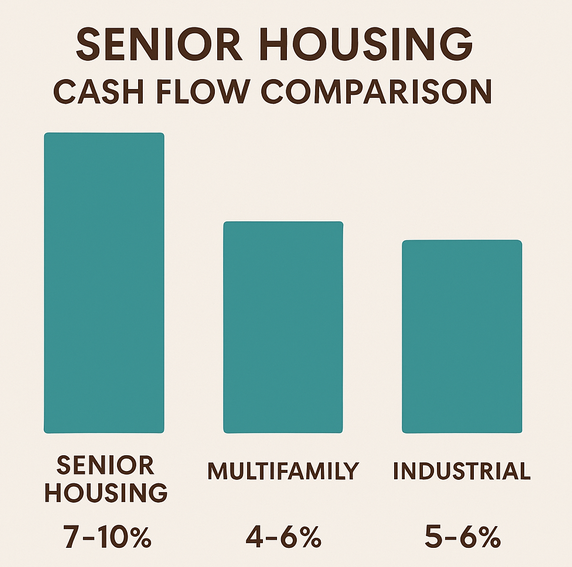

Stabilized properties remain resilient in high-interest-rate environments due to predictable income streams. The senior housing sector’s average occupancy rate reached 86.5% in Q3 2024, rebounding from pandemic lows. Such properties provide a hedge against construction risks and the rising cost of capital, ensuring steady income even during economic fluctuations.

Actionable Insights:

- Target properties with occupancy rates exceeding 85% to ensure steady revenue.

- Look for stabilized assets with long-term low fixed rate debt to reduce volatility.

- Prioritize properties in metropolitan areas where senior housing demand is consistently high, such as in cities with large retiree populations.

2. Strategic Geographic Diversification

Senior housing demand varies across regions. According to the National Investment Center for Seniors Housing & Care (NIC), the Southeast and Southwest U.S. exhibit the highest growth in demand due to population shifts and favorable tax climates.

Top States for Investment:

- Texas: Expected to see a 25% increase in its senior population by 2035. Cities like Austin and Dallas lead in demand.

- Florida: Accounts for 10% of the U.S. senior housing market, with 28% of residents aged 60+.

- North Carolina: Senior population projected to grow by 21% by 2030, driven by affordable living and mild climates.

- Georgia: Rapid urbanization in Atlanta and Savannah has created growing demand for middle-market senior housing.

- Arizona: Known for its retiree-friendly climate, Arizona’s senior population is projected to grow by 20% by 2035.

- South Carolina: Offers a mix of affordability and growth, with Charleston and Greenville leading senior housing demand.

Additional States:

- Nevada: With its low tax environment and retiree-friendly cities like Las Vegas, Nevada is seeing increased demand for senior housing.

- Colorado: Home to a growing senior population, particularly in Denver and Boulder, with an emphasis on wellness-focused facilities.

- Utah: A rapidly aging population and business-friendly climate make Utah an emerging market for senior housing.

Expansion Opportunities:

- Invest in secondary markets within these states, where land and development costs are lower, but demand is rising.

- Assess local regulations and incentives for senior housing projects, such as property tax abatements or expedited permitting.

3. Emphasize Class A and B Facilities Over Class C

The NIC MAP Vision Report highlights that Class A facilities maintain an average occupancy rate of 90%, compared to 77% for Class C properties. Class B properties, catering to middle-income seniors, remain a strong segment due to their affordability and broad market appeal.

Considerations:

- Class A facilities provide higher returns but require significant capital investment. These facilities often feature premium amenities like wellness centers, gourmet dining, and concierge services.

- Class B properties balance affordability and quality, appealing to a growing middle-income senior demographic. They are also well-suited for suburban markets with rising senior populations.

- Avoid over investment in Class C properties, as they cater to more price-sensitive tenants and are more vulnerable to economic pressures.

4. Invest in Senior Housing Services and Technology

The global elder care services market is projected to reach $1.7 trillion by 2030, growing at a CAGR of 7.5%. Telehealth services, a $25 billion market in 2024, are increasingly integrated into senior housing facilities. Additionally, the adoption of AI-powered health monitoring systems is anticipated to grow by 12% annually.

Opportunities:

- Invest in companies providing in-home care services, remote monitoring, and wellness programs.

- Partner with tech firms to integrate smart home technologies into senior housing projects, including voice-activated assistants and fall detection systems.

- Explore platforms offering virtual reality-based wellness and entertainment programs for senior residents.

5. Low-Leverage Strategies

Low-leverage investments are critical in reducing exposure to interest rate fluctuations. REITs with debt-to-equity ratios below 50%, such as National Health Investors (NHI), demonstrate higher resilience.

Best Practices:

- Focus on equity-driven acquisitions.

- Reinvest earnings into portfolio improvement rather than pursuing debt-financed expansions.

- Diversify funding sources to include institutional equity partners and private investors.

6. Government and Subsidy-Backed Opportunities

Government programs such as HUD Section 202 provide low-interest loans for affordable senior housing. In 2024, $1 billion was allocated to the Low-Income Housing Tax Credit (LIHTC) program, fostering public-private partnerships that mitigate development risks.

Key Takeaways:

- Leverage federal and state grants to offset rising construction costs.

- Collaborate with local governments to identify underserved senior populations.

- Explore opportunities for joint ventures with nonprofit organizations to qualify for additional subsidies and tax benefits.

Top Senior Housing REITs to Consider in 2025

1. Welltower Inc. (WELL)

- Portfolio: 1,400 properties across the U.S., Canada, and the U.K.

- Occupancy Rate: 89% in Q3 2024.

- Leverage Ratio: 42%, ensuring stability in volatile markets.

2. Healthpeak Properties (PEAK)

- Portfolio: $25 billion in assets, with a focus on high-growth markets.

- Dividend Yield: 5.4% in 2024, outperforming peers.

3. LTC Properties, Inc. (LTC)

- Portfolio: 200 properties, emphasizing skilled nursing facilities.

- Debt-to-Equity Ratio: 38%, among the lowest in the sector.

4. Sabra Health Care REIT, Inc. (SBRA)

- Portfolio: 450 facilities in 42 states.

- Diversification: 60% of properties in regions with above-average senior population growth.

5. National Health Investors (NHI)

- Portfolio: Long-term leases with occupancy rates exceeding 90%.

- Dividend Payout Ratio: Consistently over 85% since 2020.

Conclusion

Investing in senior housing in 2025 requires a strategic, data-driven approach. By focusing on stabilized assets, diversifying geographically, and prioritizing REITs with low leverage and solid fundamentals, investors can navigate the economic challenges posed by high interest rates and tariffs. Additionally, leveraging government-backed programs and exploring tech-driven senior care solutions can offer supplementary growth opportunities.

The senior housing sector, supported by robust demographic trends, remains a resilient and rewarding investment avenue for those who strategically align their portfolios with market dynamics.