Part I: Understanding Senior Housing

1. The Concept of Senior Housing

- Definition and Purpose: Senior housing provides living arrangements and services tailored to older adults’ needs, offering a safe, comfortable, and socially engaging environment that supports their physical, emotional, and medical needs.

- History and Evolution: From almshouses and poorhouses to modern assisted living facilities and retirement homes, the sector has evolved significantly, focusing on comfort, medical care, and social engagement.

2. The Booming Demand

- Demographic Trends: The global population is aging, with the number of people aged 65 and above expected to double over the next three decades, driving the demand for senior housing.

- Socio-economic Influences: Smaller family sizes and increased mobility mean many seniors may not have traditional family support, increasing the need for specialized housing solutions.

- Changing Attitudes: Modern senior housing emphasizes active living, community engagement, and high quality of life, making it an attractive option for today’s seniors.

Part II: Types of Senior Housing Investments

1. Independent Living Communities (ILCs)

- Key Features: Private living spaces combined with communal amenities like fitness centers, libraries, and social events, catering to active, self-sufficient seniors aged 55 and above.

2. Assisted Living Facilities (ALFs)

- Scope and Services: Private living spaces with support services such as daily tasks assistance, medication management, and wellness programs.

- Licensing and Certification: Subject to state-specific regulations and regular inspections to ensure health, safety, and care standards.

3. Memory Care Facilities

- Specialized Care: Designed for individuals with Alzheimer’s and dementia, offering secure environments and structured routines.

- Staff Training: Staff undergo specialized training in dementia care to provide effective support and manage challenging behaviors.

4. Continuing Care Retirement Communities (CCRCs)

- Integrated Care: Combine independent living, assisted living, and nursing home care on a single campus, allowing residents to transition between levels of care as needed.

- Financial Models: Typically involve a significant entrance fee and monthly service fees, covering living costs and care services.

Part III: Why Invest in Senior Housing?

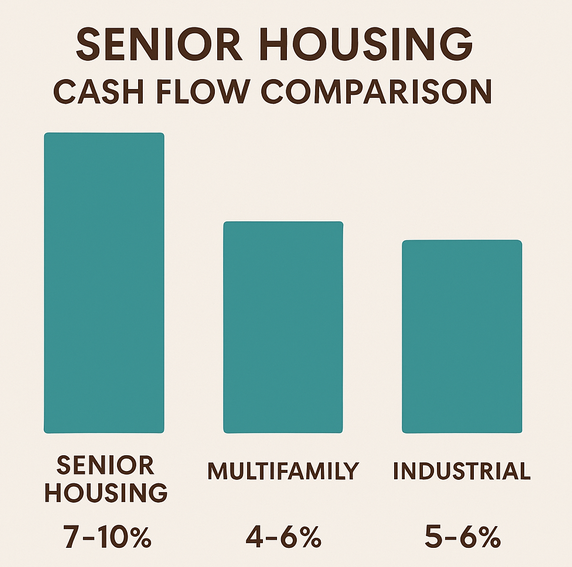

1. Consistent Income Potential

- Occupancy Rates: High demand ensures strong occupancy rates, providing stable and consistent income.

- Recurring Revenue: Monthly rents, service fees, and additional care services generate steady cash flow.

2. Long-term Appreciation Prospects

- Market Growth: Increasing life expectancy and a growing senior population drive market expansion.

- Land Value: Real estate’s finite nature ensures potential land value appreciation over time.

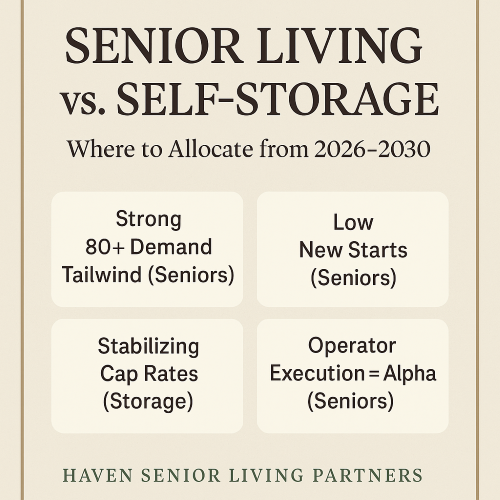

3. Portfolio Diversification Benefits

- Hedge Against Traditional Real Estate: Senior housing offers stability, even when other real estate segments might underperform.

- Economic Stability: Demand for senior care remains relatively inelastic during economic downturns.

4. Social Impact

- Enhancing Quality of Life: Investing in senior housing improves the quality of life for seniors, offering a dignified and engaging environment.

- Community Involvement: Facilities often become integral parts of local communities, fostering inter-generational programs and local partnerships.

Part IV: Navigating Pitfalls in Senior Housing Investments

1. Market and Location Analysis

- Demographics: Understand the local senior population and their specific needs.

- Proximity to Amenities: Ensure the facility is near essential services like healthcare, shopping centers, and recreational facilities.

2. Regulations and Licensing Requirements

- State-specific Regulations: Be well-versed in local regulations covering facility design, staffing ratios, and care protocols.

- Compliance and Audits: Regularly meet or exceed regulatory standards to avoid fines and maintain a good reputation.

3. Management and Operational Considerations

- Staffing and Training: Hire qualified, compassionate staff and ensure continuous training.

- Facility Maintenance: Regular maintenance and upgrades keep the facility competitive and appealing.

4. Understanding the Risks

- Economic Risks: Be aware of broader economic forces that can affect profitability.

- Industry-specific Risks: Mitigate risks like lawsuits and health outbreaks with proper protocols and insurance.

Part V: Step-by-Step Investment Process

1. Market Research and Analysis

- Tools and Data Sources: Use reputable data sources for thorough market analysis.

- Identifying Emerging Markets: Look for areas with growing senior populations but undersupply of senior housing.

2. Assessing Financial Feasibility

- Cost Breakdown: Itemize projected costs and account for potential unforeseen expenses.

- Expected Returns: Estimate potential revenue streams and analyze profit margins.

3. Securing Financing or Investment Partners

- Traditional Loans vs. Investor Partnerships: Weigh the benefits of each financing method.

- Evaluating Loan Terms: Negotiate to get the best financing deal.

4. Acquiring and Developing Property

- Site Selection: Choose sites based on market research and proximity to amenities.

- Construction and Design: Engage experienced architects to design senior-friendly facilities.

5. Managing for Long-term Success

- Management Options: Decide between hiring management companies or in-house management.

- Maintenance and Marketing: Develop a proactive maintenance plan and robust marketing strategy.

In conclusion, investing in senior housing requires careful planning and informed decisions. By understanding market dynamics, regulatory requirements, and operational needs, investors can achieve both financial success and contribute to a noble cause. With diligence, the right resources, and a clear vision, senior housing investments can offer significant rewards.