Senior housing syndications have become increasingly popular among investors seeking stable returns and diversification in the real estate sector. A syndication allows a group of investors to pool their capital to acquire and manage a property under the leadership of a sponsor or general partner. One question that often arises is whether you can invest in a leveraged (i.e., debt-financed) senior housing syndication using a Roth IRA. The short answer is yes, you can, by using a self-directed IRA. However, there are additional considerations and potential tax implications you should be aware of—particularly around Unrelated Debt-Financed Income (UDFI) and Unrelated Business Income Tax (UBIT).

In this article, we’ll walk through the key steps and considerations you need to understand if you plan to use your Roth IRA to invest in a senior housing syndication that involves leverage.

1. The Basics of Self-Directed Roth IRAs

A self-directed IRA is a retirement account that allows you to invest in alternative assets—such as real estate, notes, private placements, and more—beyond the typical stock, bond, or mutual fund. To invest in a real estate syndication with your Roth IRA, you need a self-directed Roth IRA custodian that permits alternative investments.

- Open a Self-Directed Roth IRA

You must work with a specialized custodian or trust company that can handle nontraditional assets. The process typically involves completing an account application, funding or rolling over existing retirement assets, and signing specific disclosures regarding alternative investments. - Identify a Senior Housing Syndication

Once your self-directed Roth IRA is established, you’ll identify a senior housing deal that meets your investment criteria. You will not invest personally but rather direct your IRA custodian to invest on the IRA’s behalf. - Invest in the Syndication

All paperwork will be done in the name of your IRA (e.g., “XYZ Trust Company FBO [Your Name] Roth IRA”). Returns—whether rental income or eventual profits from a sale—will flow back into the IRA, preserving the tax-advantaged status.

2. Understanding Prohibited Transactions and Disqualified Persons

The IRS imposes strict rules on how IRA funds can be used, particularly when it comes to real estate:

- Prohibited Transactions

You cannot personally benefit from the IRA-owned property outside of the arrangement. For instance, you cannot live in the property, manage it personally without compensation structures in place, or otherwise use the asset for non-investment purposes. - Disqualified Persons

Generally, “disqualified persons” include you (the IRA owner), your spouse, your linear ascendants and descendants (parents, grandparents, children, grandchildren), and certain business entities you control. None of these individuals may benefit directly from the IRA investment or provide non-arm’s length services to it.

These rules ensure that your IRA remains purely an investment vehicle and does not provide immediate personal benefits. Violating these rules can cause your entire IRA to become disqualified, leading to serious tax consequences.

3. Why Senior Housing?

Senior housing (also referred to as senior living or assisted living, depending on services provided) has gained significant attention in recent years due to shifting demographics:

- Growing Demand

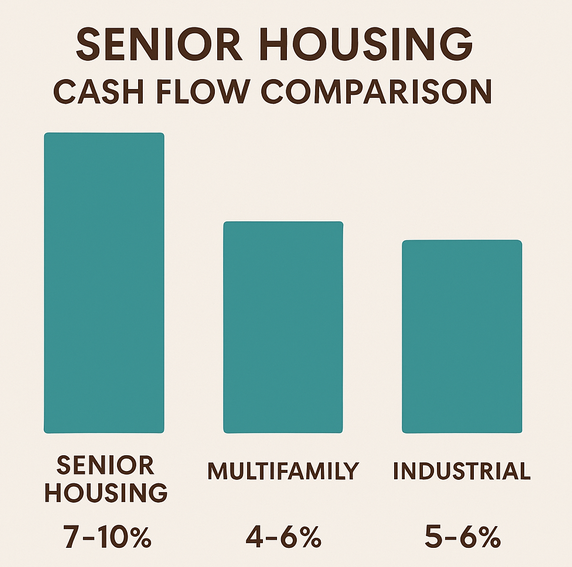

As the baby boomer generation ages, demand for senior housing is expected to increase substantially. Facilities that offer healthcare assistance, community activities, and accessibility features often command stable occupancy rates. - Potential for Steady Cash Flow

If managed properly, senior housing properties can generate regular rental and service-fee income. For investors focused on retirement accounts, a stable income stream can be especially attractive. - Professional Management

In a syndication, a professional sponsor will handle day-to-day operations, licensing, and staffing. This allows IRA investors to be more hands-off, which is a plus when dealing with strict IRA rules about prohibited transactions.

4. Leverage and Its Implications in an IRA

When you invest in a real estate deal that uses debt or a mortgage, part of the income derived is typically considered Unrelated Debt-Financed Income (UDFI) if the borrower is your tax-exempt entity (in this case, your IRA). Because your Roth IRA is otherwise tax-exempt, this portion of the income can be subject to Unrelated Business Income Tax (UBIT) at trust tax rates.

- What Is UDFI?

UDFI (Unrelated Debt-Financed Income) arises when tax-exempt entities (like IRAs) earn income from leveraged property. Essentially, the IRS says, “If you’re using debt to magnify your returns, you’re running a business-like activity.” The leveraged portion’s share of income and gains is potentially taxable, even within an IRA. - How UBIT Is Calculated

UBIT (also called UBTI, Unrelated Business Taxable Income) is typically calculated as a percentage of the total income or gain proportional to the debt on the property. For example, if 50% of the property was financed by a loan, then approximately 50% of the income or gain might be subject to UBIT. - How to Pay UBIT

The IRA itself, not you personally, is responsible for any tax liability. Your self-directed IRA custodian would file Form 990-T on behalf of your IRA and use IRA funds to pay any resulting tax. You won’t pay that tax out of your personal funds—that would be a prohibited contribution. - Does UBIT Erase the Benefits?

UBIT can reduce the effective return in a leveraged deal. However, even with UBIT, investors often find the returns can still be favorable compared to other investments. The presence of leverage typically increases buying power, which can amplify overall returns. It’s critical to consult with a CPA familiar with self-directed IRAs and real estate to understand the net effect on your potential returns.

5. Steps to Invest with Leverage Involved

Here is a concise step-by-step process to guide you:

- Establish/Convert to a Self-Directed Roth IRA

- Choose a reputable custodian that offers real estate and private placement options.

- Complete the necessary paperwork to open or roll over funds into the self-directed Roth IRA.

- Due Diligence on the Senior Housing Syndication

- Review the sponsor’s track record, market studies, projected returns, and the specific business plan.

- Understand the financing structure: how much leverage is involved, interest rates, loan terms, etc.

- Discuss UBIT Implications with a Tax Professional

- Have a CPA model the potential impact of UBIT on your returns.

- Make sure you’re prepared for the administrative requirements (e.g., Form 990-T).

- Subscribe to the Syndication

- When you decide to invest, you’ll receive subscription documents from the sponsor.

- The subscription should list your self-directed IRA (not you personally) as the investor.

- Fund the investment from your IRA custodian directly to the syndication.

- Ongoing Operations and Distributions

- The syndication sponsor manages the property.

- Cash flow distributions are sent to your IRA custodian.

- The sponsor provides K-1s or other relevant forms each year, which your IRA custodian needs for any required UBIT filings.

- Exit Event

- Upon refinance or sale of the property, your IRA receives its share of the proceeds.

- You can choose to reinvest those funds in another self-directed IRA opportunity or keep them in the IRA’s cash balance until the next opportunity arises.

6. Additional Considerations

- Holding Period & Liquidity: Real estate syndications typically have a multi-year holding period. Your funds will be illiquid during this time, so be comfortable with that in the context of your overall retirement timeline.

- Reporting Requirements:

- Make sure your sponsor is experienced in dealing with IRA investors and can provide accurate K-1s or other tax documents in a timely manner.

- The IRA custodian will need these documents to assess any UBIT liability.

- Professional Advice:

Working with advisors who have direct experience in self-directed IRAs and leveraged real estate is crucial. A misstep (e.g., prohibited transaction) can disqualify your IRA and trigger hefty taxes and penalties. - Plan for Administrative Costs:

Self-directed IRA custodians often charge setup fees, annual fees, and transaction fees. Make sure you fully understand and budget for these costs so they don’t erode your returns more than expected.

Conclusion

Investing in a senior housing syndication that uses leverage can be an effective way to grow your Roth IRA—potentially providing diversification, strong cash flow, and future upside. However, once leverage enters the picture, Unrelated Debt-Financed Income (UDFI) and Unrelated Business Income Tax (UBIT) become important considerations. As long as you structure the investment properly—through a self-directed IRA custodian—and remain in compliance with IRS rules, it can be a viable and rewarding retirement strategy.

Key Takeaways:

- A self-directed Roth IRA can invest in leveraged senior housing syndications.

- Leverage in your IRA investment triggers potential UBIT obligations, requiring you (or rather your IRA) to pay taxes on the debt-financed portion.

- Proper planning, strict adherence to prohibited transaction rules, and working with knowledgeable professionals are essential to maximize benefits and stay compliant.

If you’re interested in exploring such an opportunity, begin by consulting both a self-directed IRA custodian and a CPA experienced in IRA-held real estate. Their guidance, combined with thorough due diligence on the syndication itself, can help you confidently navigate this potentially lucrative investment path.

Disclaimer: The following information is for educational purposes only and is not intended as tax, legal, or financial advice. Consult with a qualified tax advisor, attorney, or financial professional before making any investment decisions.