In 2025, investor interest in senior housing is experiencing an unprecedented surge. A combination of demographic shifts, economic factors, and evolving care models is driving this market to new heights. As aging baby boomers reshape the senior living landscape, real estate investors and institutional capital are increasingly viewing senior housing as one of the most resilient and profitable asset classes. Here’s why this sector is booming in 2025.

1.The Silver Tsunami: A Demographic Powerhouse

The U.S. is witnessing an unprecedented rise in the senior population, with 10,000 baby boomers turning 65 every day. According to U.S. Census projections, by 2030, all boomers will be at least 65, and by 2050, nearly 90 million Americans will be 65 or older. This demographic shift is creating immense demand for senior living communities, from independent living to memory care.

2. Increased Life Expectancy and Changing Preferences

Seniors are living longer, healthier lives, and they have different expectations from previous generations. Today’s seniors are prioritizing lifestyle, wellness, and social engagement over traditional nursing home models. Modern senior housing communities now focus on amenities such as fitness centers, on-site healthcare, and technology-driven care solutions, making them more attractive investment opportunities.

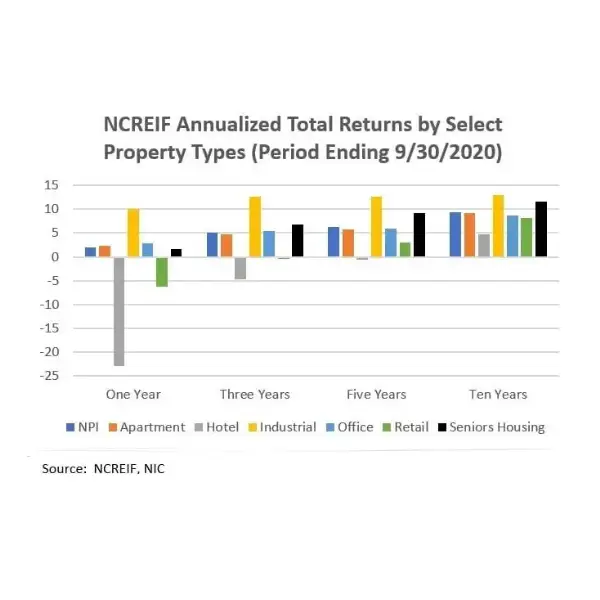

3. Strong Financial Performance and Resilience

Senior housing has consistently outperformed other real estate asset classes, demonstrating resilience even during economic downturns. In 2025, occupancy rates in senior housing are rising, rental rates are increasing, and investment returns remain strong. This performance is drawing significant interest from private equity, REITs, and institutional investors looking for stable, long-term gains.

4. Growing Demand for Specialized Care

The demand for specialized care communities, such as memory care and assisted living, is growing at a rapid pace. With rising diagnoses of Alzheimer’s and other cognitive disorders, dedicated memory care facilities are seeing increased occupancy. Investors are drawn to these segments due to their higher revenue potential and long-term demand stability.

5. Government Policies and Incentives

Federal and state governments are increasingly recognizing the importance of senior housing in addressing aging population needs. In 2025, policies such as tax incentives, grants for senior-friendly infrastructure, and Medicare and Medicaid support for assisted living are making investment in senior housing even more attractive.

6. Technological Advancements Enhancing Senior Living

Technology is revolutionizing senior housing, making it more efficient and appealing to investors. Innovations such as telehealth services, AI-powered health monitoring, and smart home integrations are improving the quality of life for seniors while optimizing operational efficiencies for facility operators. These advancements are making senior housing a forward-thinking, technology-driven investment.

7. The Shift from Traditional Healthcare Models

With hospitals and long-term care facilities facing capacity challenges, senior housing communities are filling the gap by offering medical and wellness services in residential settings. This shift not only reduces healthcare costs but also provides an improved quality of life for seniors. Investors recognize the potential of these hybrid models that blend real estate with healthcare services.

8. Favorable Capital Markets and Financing Options

Lenders and financial institutions are increasingly offering competitive financing options for senior housing developments. The availability of low-interest loans, government-backed financing, and strong private equity interest has made it easier for developers and investors to enter the senior housing market.

Conclusion

The senior housing market is at the forefront of real estate investment in 2025, driven by demographic trends, strong financial performance, evolving care models, and technological innovation. With demand expected to outpace supply in the coming years, investors who recognize the long-term potential of this sector are positioning themselves for significant returns. As the landscape of senior living continues to evolve, strategic investments in this space are set to redefine the future of aging in America.