Behind Haven Senior Living Partners’ (HSLP) operations is an abundance of financial savvy and strategy. As an investor, it’s essential to understand what happens when subscribing to an investment.

For this post, we sat down with industry experts at HSLP to unpack high-level financial terminology, monetary aspects of the senior housing industry, and the perks of investing in this rapidly growing sector.

Subscribing to an Investment

At HSLP, we syndicate capital into senior housing real estate assets. When you subscribe to an investment with HSLP, you take ownership in an LLC (Limited Liability Company), whose sole purpose is to own either a senior housing facility or a grouping of other special purpose entities, each owning a single asset. Taking ownership of this gives you (the investor) tax documents to represent ownership, alongside that ownership’s respective rights, responsibilities, and economic benefits.

Keep in mind—an LLC is the best entity structure for investors. Investors are passive and have no scope of operation, directing all liability onto HSLP.

Owning an LLC also comes with special tax benefits because you are benefiting from all the profit and loss of that operation. Additionally, with real estate and other hard asset investments, you have depreciation—which gets passed through like other tax implications. Your ownership represents your percentage of depreciation allocation.

Preferred Return and Matching the Market

Investors with HSLP receive a preferred return, often around 8-9%, meaning they get prioritized returns on their investment.

HSLP recognizes that investors are trading their capital, while we are trading time, expertise, and operational oversight. The value of their capital is significant, and we ensure that our financial structures reflect this understanding.

We also align our returns with market expectations in terms of risk-adjusted return, ensuring competitive performance in various locations. Success is measured through different ROI metrics, including cash-on-cash return and internal rate of return. Since passive investors benefit from cash flow, HSLP ensures optimal cash distributions throughout the investment period.

Reasons to Invest in Senior Housing

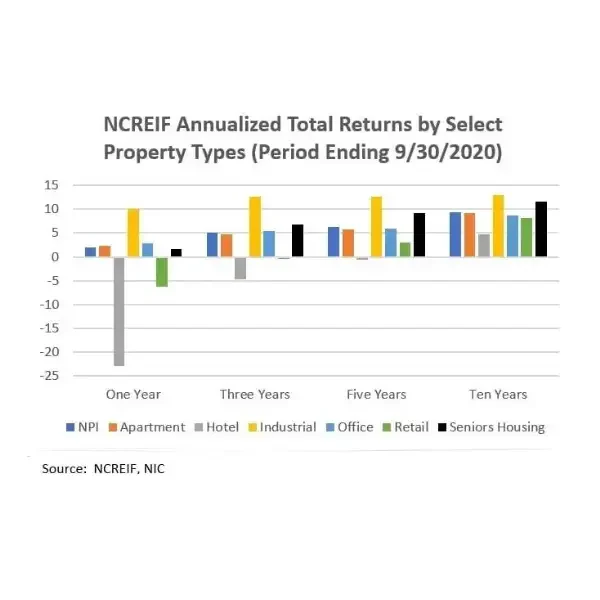

Now let’s talk about senior housing: a resilient and rapidly expanding asset class with strong long-term demand.

Senior housing investments offer three key advantages: demographic-driven demand, operational stability, and strong government support.

For context—America’s aging population is increasing at an unprecedented rate. By 2030, all Baby Boomers will be 65 or older, and by 2050, the 85+ population is expected to triple. Currently, over 10,000 Americans turn 65 every day, creating an insatiable demand for senior housing options.

Unlike other asset classes, senior housing benefits from demographic predictability. Occupancy rates remain strong due to an aging population, and the need for assisted living, memory care, and independent living facilities continues to grow.

Additionally, senior housing is partially insulated from economic downturns. While traditional real estate sectors may struggle during recessions, the demand for senior care remains consistent. Government programs such as Medicare and Medicaid also provide financial support, further stabilizing the sector.

Strong Market Fundamentals

A growing senior population, paired with a current under supply of senior housing, creates an attractive investment opportunity. The senior housing market is expected to grow from $83 billion in 2020 to over $140 billion by 2030, emphasizing the sector’s potential for strong returns.

At Haven Senior Living Partners, we leverage our expertise, industry relationships, and deep market insights to provide investors with access to high-quality senior housing investment opportunities. With an aging population and increasing demand, now is the time to consider senior housing as a strategic, long-term investment.