The aging population in the United States continues to drive demand for senior housing, making it an attractive investment sector. When this investment intersects with Opportunity Zones, the potential for financial and social returns becomes even greater. Opportunity Zones (OZs), created as part of the Tax Cuts and Jobs Act of 2017, were designed to spur economic development and job creation in economically distressed areas. Combining the growth of senior housing with the tax advantages of OZs creates a compelling case for investors.

What Are Opportunity Zones?

Opportunity Zones are designated low-income census tracts that offer tax incentives to investors to encourage long-term investments in these areas. By investing through a Qualified Opportunity Fund (QOF), individuals can defer, reduce, or even eliminate certain capital gains taxes.

As of today, there are over 8,700 Opportunity Zones in the United States, covering urban, suburban, and rural areas. These zones were strategically selected to attract investment to regions that need economic revitalization, and many of them are prime locations for senior housing developments.

Why Senior Housing in Opportunity Zones?

Senior housing is a growing industry, fueled by demographics and increasing healthcare needs. The U.S. Census Bureau projects that by 2034, older adults will outnumber children for the first time in history. This “Silver Tsunami” creates a pressing demand for senior living options such as independent living, assisted living, memory care, and skilled nursing facilities.

Many Opportunity Zones overlap with areas that have aging populations but lack adequate senior housing infrastructure. By investing in senior housing within OZs, investors can address a critical societal need while capitalizing on favorable tax incentives.

Tax Benefits of Opportunity Zone Investments

Here are the key tax benefits of investing in Opportunity Zones:

Deferral of Capital Gains Taxes: When an investor sells an asset, such as stock or real estate, and reinvests the gain into a QOF within 180 days, they can defer paying capital gains tax until December 31, 2026, or until the Opportunity Zone investment is sold, whichever comes first.

Reduction in Capital Gains Taxes: If the investment is held for at least five years, the investor receives a 10% reduction in the deferred gain. If held for seven years, the reduction increases to 15%. With the 2026 deadline approaching, investors may only be able to capture the five-year benefit. We expect that this program will be extended in 2025.

Exclusion of Gains on the OZ Investment: The most significant benefit comes if the Opportunity Zone investment is held for at least 10 years. Any appreciation on the OZ investment itself is entirely tax-free. For example, if an investor develops senior housing in an OZ and sells it after 10 years, the gain from the sale is not subject to federal capital gains tax.

The Business Case for Senior Housing in Opportunity Zones

Combining the social mission of senior housing with Opportunity Zone incentives aligns financial returns with community impact. Here are a few reasons why this combination is appealing:

Growing Demand: Senior housing remains resilient even in economic downturns because of its necessity-driven nature. In Opportunity Zones, the demand is amplified as many areas are underserved.

Affordable Land and Development Costs: Opportunity Zones often offer lower land acquisition costs and development expenses compared to more developed areas, allowing investors to stretch their capital further.

Community Impact: Developing senior housing in Opportunity Zones creates jobs, enhances healthcare infrastructure, and provides a critical service to elderly residents who may otherwise lack access to quality living environments.

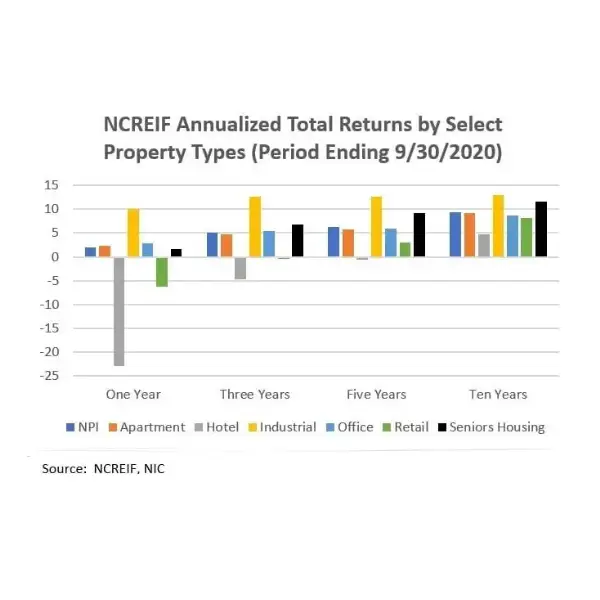

Long-Term Returns: The potential tax-free appreciation of an Opportunity Zone investment after 10 years adds significant value to the long-term returns of senior housing projects.

Challenges and Considerations

While the benefits are attractive, investors must carefully evaluate several factors before proceeding:

Regulatory Compliance: QOF investments are subject to strict compliance rules to ensure they are driving meaningful economic activity in Opportunity Zones.

Market Research: Investors should conduct thorough market studies to confirm the demand for senior housing in a particular Opportunity Zone.

Project Execution: Senior housing developments require expertise in operations, healthcare, and real estate. Partnering with experienced operators is essential.

Conclusion

Investing in senior housing located in Opportunity Zones presents a unique opportunity for investors to generate strong financial returns while creating meaningful social impact. The tax advantages provided by the Opportunity Zone program, coupled with the increasing demand for senior housing, make this a powerful investment strategy.

Reach out to us to learn more.