Senior Housing Exit Strategies: What Happens After Year 5?

The investment horizon ends—but your opportunities don’t. In most senior housing syndications or joint ventures, the typical hold period is 5 to 7 years. But what happens next can significantly impact your returns, tax planning, and reinvestment opportunities. This blog breaks down the four most common exit strategies investors should understand before signing on. Refinancing […]

How to Vet an Operator in a Senior Housing Deal

Your deal is only as strong as the senior housing team running it. In senior housing investing, real estate is only half the equation. The other half—the one that can make or break your investment—is the operator. Whether you’re evaluating a deal as an LP or structuring one as a GP, operator quality is the […]

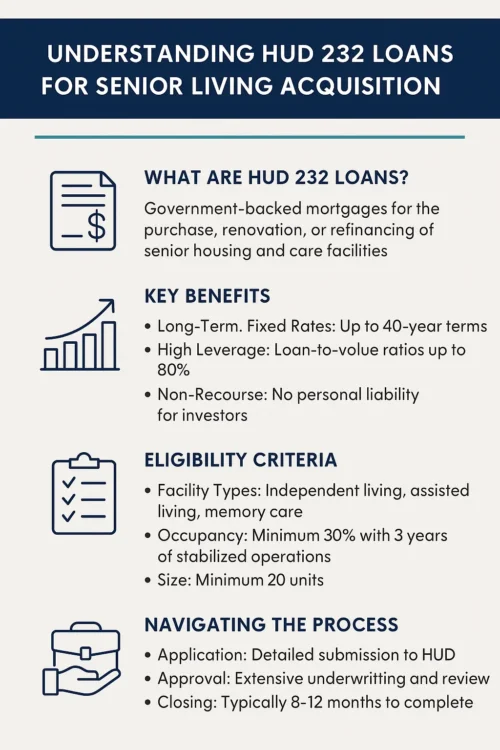

Understanding HUD 232 Loans for Senior Living Acquisition

Your guide to one of the most powerful—and underutilized—tools in senior housing finance. When acquiring or refinancing a senior living community, few options compare to the HUD 232 loan. With fixed interest rates, long amortization periods, and non-recourse protection, this FHA-backed mortgage product has become a go-to solution for experienced senior housing investors. Let’s break […]

How Do Senior Housing Investments Perform During a Recession?

How Do Senior Housing Investments Perform During a Recession? Spoiler alert: Better than most. In times of economic uncertainty, investors seek assets that provide stability, consistent returns, and long-term growth. Senior housing has increasingly emerged as one of those rare asset classes—blending real estate, healthcare, and hospitality—capable of withstanding market volatility. Let’s explore why. 1. […]

Investing in a Senior Housing Syndication with a Roth IRA

Senior housing syndications have become increasingly popular among investors seeking stable returns and diversification in the real estate sector. A syndication allows a group of investors to pool their capital to acquire and manage a property under the leadership of a sponsor or general partner. One question that often arises is whether you can invest […]

Navigating the World of Senior Living Investments: A Comprehensive FAQ

The landscape of real estate investment is diverse, but one sector that’s gaining attention, thanks to demographic shifts, is senior living. Whether you’re a seasoned investor or new to the field, understanding the nuances of investing in facilities for the elderly is crucial. Here, we’ve compiled an extensive FAQ to guide you through the complexities […]

Why Texas Is a Top State for Investing in Senior Housing

The senior housing market is rapidly evolving, with demand outpacing supply in many regions across the United States. Among the top states capturing investor attention, Texas stands out as a premier destination for senior housing investments. With its robust economy, growing senior population, and business-friendly environment, the Lone Star State offers a unique opportunity for […]

Supply vs. Demand Imbalance in Senior Living Development and Investment

In 2025, demand for senior housing is surging and supply is constrained due to financing challenges, rising construction costs, and labor shortages. Given these factors, the best way to navigate the supply vs. demand imbalance in senior living development and investment includes: 1. Focus on Repositioning Existing Properties 2. Creative Financing and Capital Strategies 3. […]

Georgia: A High-Growth Market for Senior Housing Investment

Georgia has become one of the fastest-growing states for retirees, thanks to its affordable cost of living, mild climate, and strong healthcare infrastructure. As the senior population continues to grow, demand for independent living, assisted living, and memory care communities is surging, making Georgia a prime market for senior housing investment. Why Georgia is an […]

Tennessee: A Prime Destination for Senior Housing Investment

Tennessee has emerged as a top choice for retirees due to its affordability, no state income tax, and growing senior population. With increasing demand for independent living, assisted living, and memory care communities, Tennessee offers a wealth of opportunities for senior housing investment. Why Tennessee is a Strong Market for Senior Housing Investment 1. Rapid […]