Can Senior Housing Investments Be Impact Investments?

Yes—where purpose meets performance. Most investors think of senior housing as a stable, income-producing real estate asset. And they’re right. But what many overlook is that senior housing—done well—can also be one of the most meaningful, values-aligned investments you can make. Let’s explore how senior housing delivers more than returns—it delivers impact. Preserving Dignity for […]

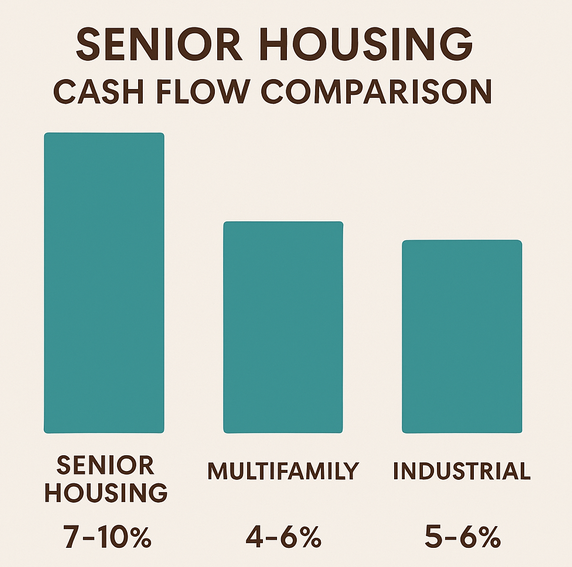

How Does Senior Housing Cash Flow Compare to Other Asset Classes?

Higher complexity, higher reward. Cash flow is a top priority for real estate investors—especially those looking for consistent distributions and strong risk-adjusted returns. But how does senior housing stack up against more familiar asset classes like multifamily or industrial? Let’s break down the numbers and explore what drives senior housing’s higher yield potential. Cash-on-Cash Return […]

Can I Use a 1031 Exchange in Senior Housing?

Yes—but only in specific situations. The 1031 exchange is one of the most powerful tools in a real estate investor’s playbook. It allows you to defer capital gains taxes by reinvesting proceeds from the sale of one investment property into another “like-kind” property. But when it comes to senior housing, things get a bit more […]

What Risks Are Unique to Senior Housing Investments?

It’s not just real estate—it’s regulated care. Senior housing is one of the most compelling real estate sectors for long-term investors. It blends demographic tailwinds with income-generating assets. But it’s also unlike any other asset class—and with that uniqueness comes distinct risks. Understanding these risks doesn’t mean avoiding the sector. It means knowing what to […]

How Are Senior Housing Deals Structured?

Understanding the waterfall before you dive in. Investing in senior housing can feel intimidating if you’re unfamiliar with how these deals are structured. But once you understand a few key terms—like equity splits, preferred returns, and promotes—it becomes much easier to evaluate opportunities with clarity and confidence. Here’s a breakdown of how most senior housing […]

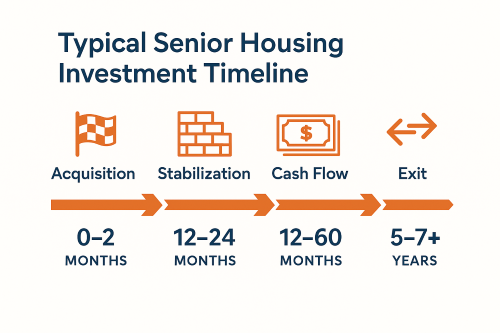

What Is the Typical Timeline for a Value-Add Senior Housing Investment?

From first dollar in to final distribution. Senior housing value-add investments offer attractive returns, but they follow a timeline that’s unique compared to other asset classes. Understanding what to expect—when returns begin, how long capital is committed, and when an exit occurs—can help investors plan better and feel more confident. Here’s a step-by-step breakdown of […]

Middle Market Senior Housing: The Sleeping Giant

Too rich for Medicaid. Too poor for luxury. Too big to ignore. The senior housing market is preparing for a seismic shift—and the middle market is at the epicenter. With over 14 million middle-income seniors projected by 2033, this segment is underbuilt, underserved, and full of opportunity for forward-thinking investors. Let’s explore why middle-market senior […]

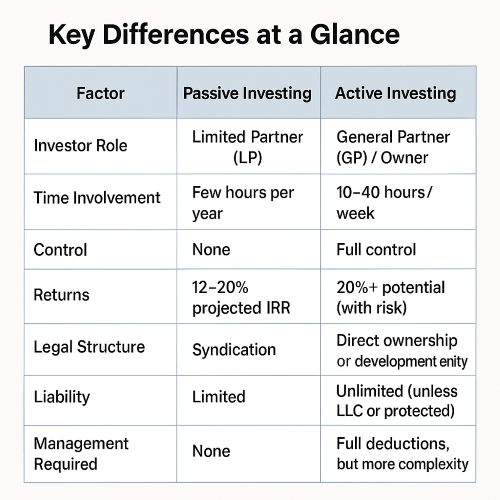

Passive vs. Active Investing in Senior Housing

Two paths. One goal: cash flow with impact. Senior housing is one of the most promising real estate sectors of the next two decades. But how you participate—passively or actively—can dramatically impact your time, returns, tax exposure, and stress level. This guide breaks down the pros and cons of each approach so you can decide […]

What Is the Ideal Unit Mix for a Profitable Senior Housing Community?

The blueprint behind top-performing assets. Ask any experienced developer or operator, and they’ll tell you: unit mix matters. The right combination of assisted living, independent living, and memory care can optimize both resident satisfaction and investor returns. In this post, we explore the “sweet spot” for profitability and why a balanced care continuum is essential […]

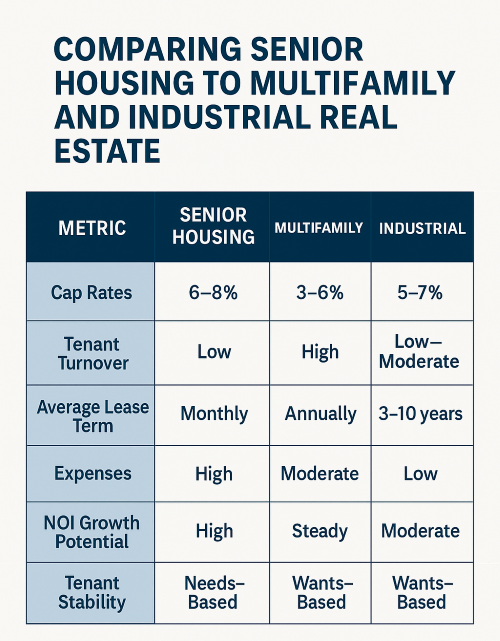

Comparing Senior Housing to Multifamily and Industrial Real Estate

Three asset classes. One investor. Which one delivers the best long-term value? If you’re deciding where to place your next real estate dollar, you’ve likely considered multifamily or industrial. But senior housing is increasingly entering the conversation—and for good reason. It offers both recession resilience and income potential few other asset classes can match. Here’s […]