Real estate syndications represent a compelling investment avenue, offering high-net-worth individuals (HNWI) the opportunity to access institutional-quality properties with significant return potential, tax efficiency, and diversification benefits without the burden of day-to-day management.

What is a Real Estate Syndication?

A real estate syndication pools capital from multiple investors to acquire larger, high-quality properties. Typically, a syndication is managed by experienced professionals (the sponsor), who oversee operations, manage the asset, and ultimately drive its profitability.

Key Advantages for High Net Worth Investors:

Passive Income: Investors receive ongoing distributions without actively managing properties.

Professional Management: Experienced sponsors handle property acquisition, management, and eventual sale.

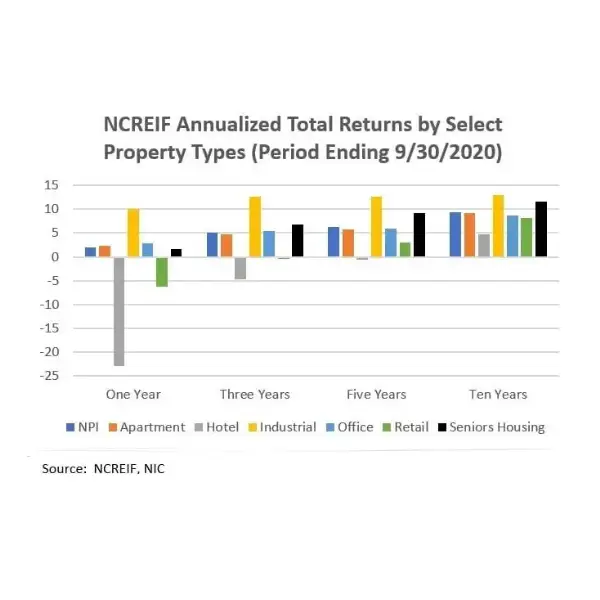

Diversification: Opportunities to invest across different markets, asset classes, and property types.

Tax Advantages: Significant tax benefits, including depreciation deductions, which can offset taxable income and enhance after-tax returns.

Understanding the Investment Lifecycle:

Acquisition Phase: Sponsors identify and acquire assets, performing rigorous due diligence.

Operational Phase: Properties are managed, optimized, and stabilized. Investors typically receive regular distributions.

Disposition Phase: Properties are sold after achieving target objectives, with investors receiving their initial investment plus capital gains.

Navigating Tax Implications:

Syndications issue K-1 forms annually, reflecting investors’ share of income, deductions, and losses. Depreciation, particularly accelerated through cost segregation, provides substantial tax sheltering. At exit, careful tax planning—such as reinvestment in new syndications, Opportunity Zones, or utilizing 1031 exchanges—can mitigate capital gains exposure.

Evaluating a Syndication:

Sponsor’s Track Record: Assess experience, performance history, and credibility.

Market Fundamentals: Evaluate economic conditions, demographics, and growth indicators.

Deal Structure and Returns: Understand projected returns, fee structures, preferred returns, and profit splits.

Getting Started:

Begin by identifying seasoned syndicators with transparent communication and proven track records. Engage professional advisors to assess opportunities, ensuring alignment with your financial objectives and risk tolerance.

Ready to Explore Real Estate Syndications?

Take advantage of exclusive investment opportunities tailored specifically for sophisticated investors seeking growth, tax efficiency, and wealth preservation. Connect with us today to learn how syndications can enhance your investment portfolio and optimize your financial legacy.